Eb5 Investment Immigration for Dummies

Eb5 Investment Immigration for Dummies

Blog Article

Get This Report on Eb5 Investment Immigration

Table of ContentsHow Eb5 Investment Immigration can Save You Time, Stress, and Money.How Eb5 Investment Immigration can Save You Time, Stress, and Money.Getting The Eb5 Investment Immigration To Work3 Simple Techniques For Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration

Contiguity is established if census tracts share boundaries. To the level feasible, the combined census tracts for TEAs must be within one city location without more than 20 census tracts in a TEA. The consolidated census systems must be a consistent form and the address need to be centrally located.For more details about the program go to the U.S. Citizenship and Immigration Solutions internet site. Please enable one month to refine your request. We normally respond within 5-10 company days of receiving qualification requests.

The U.S. government has actually taken steps aimed at boosting the level of international financial investment for virtually a century. This program was broadened with the Migration and Race Act (INA) of 1952, which created the E-2 treaty financier class to further bring in foreign financial investment.

workers within two years of the immigrant investor's admission to the USA (or in particular scenarios, within a reasonable time after the two-year period). In addition, USCIS might attribute investors with maintaining jobs in a troubled company, which is defined as a business that has actually been in existence for at the very least two years and has actually suffered a net loss during either the previous twelve month or 24 months before the concern date on the immigrant capitalist's first application.

The Main Principles Of Eb5 Investment Immigration

The program maintains rigorous capital needs, calling for candidates to show a minimum qualifying investment of $1 million, or $500,000 if invested in "Targeted Work Locations" (TEA), that include specific designated high-unemployment or country areas. The majority of the authorized regional facilities create financial investment chances that are located in TEAs, which qualifies their international financiers for the reduced financial investment threshold.

To certify for an EB-5 visa, a capitalist needs to: Invest or be in the procedure of investing at the very least $1.05 million in a new business venture in the United States or Invest or be in the procedure of spending at the very least $800,000 in a Targeted Employment Area. One method is by establishing up the financial investment company in a financially challenged location. You may contribute a lower commercial investment of $800,000 in a country location with less than 20,000 in population.

Eb5 Investment Immigration Things To Know Before You Buy

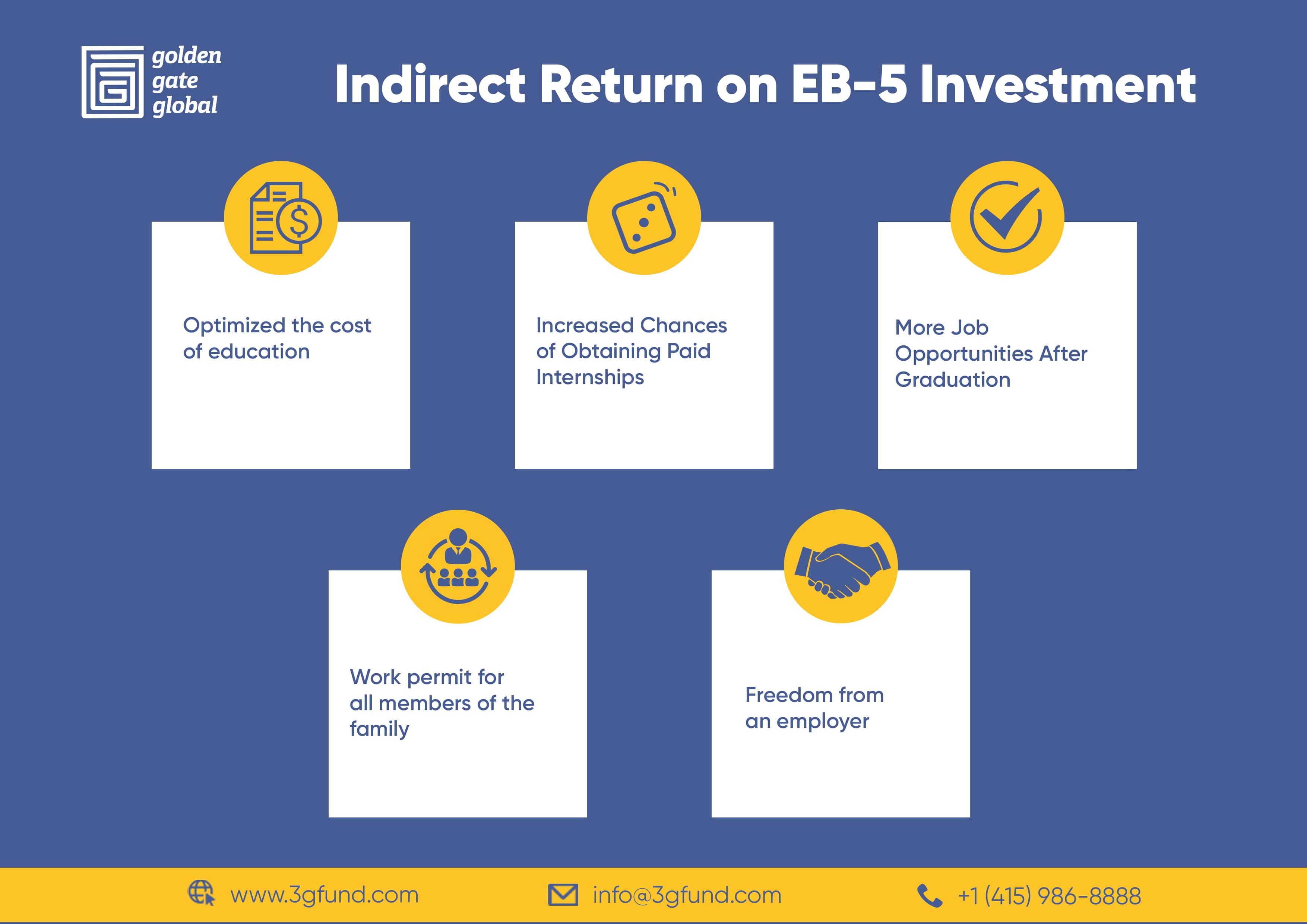

Regional Facility financial investments enable for the factor to consider Continued of financial impact on the local economic climate in the form of indirect employment. Any financier considering investing with a Regional Center must be very mindful to think about the experience and success rate of the business before spending.

The investor initially needs to file an I-526 petition with U.S. Citizenship and Migration Provider (USCIS). This request must include evidence that the investment will certainly produce permanent employment for at the very least 10 U.S. citizens, long-term locals, or other immigrants who are licensed to operate in the United States. After USCIS approves the I-526 petition, the investor may get a copyright.

Little Known Questions About Eb5 Investment Immigration.

If the capitalist is outside the United States, they will need to go through consular handling. Financier eco-friendly cards come with problems attached.

The new area generally allows good-faith capitalists to retain their eligibility after termination of their local facility or debarment of their NCE or JCE. After we notify financiers of the termination or debarment, they may retain qualification either by informing us that they continue to meet eligibility needs notwithstanding the termination or debarment, or by modifying their request to show that they fulfill the demands under area 203(b)( 5 )(M)(ii) of the INA (which has different needs depending on whether the financier is looking for to maintain eligibility due to the fact that their regional facility was terminated or because their NCE or JCE was debarred).

In all situations, Get More Information we will certainly make such decisions constant with USCIS plan concerning deference to prior decisions to make sure constant adjudication. After we terminate a regional facility's classification, we will certainly revoke any type of Kind I-956F, Application for Authorization of an Investment in a Company, connected with the terminated regional center if the Kind I-956F was accepted since the date on the local center's discontinuation notification.

What Does Eb5 Investment Immigration Do?

Report this page